SaaS Metrics – Cheat-Sheet

Quantitative metrics to drive a scalable, sustainable business in SaaS Kalaari Capital

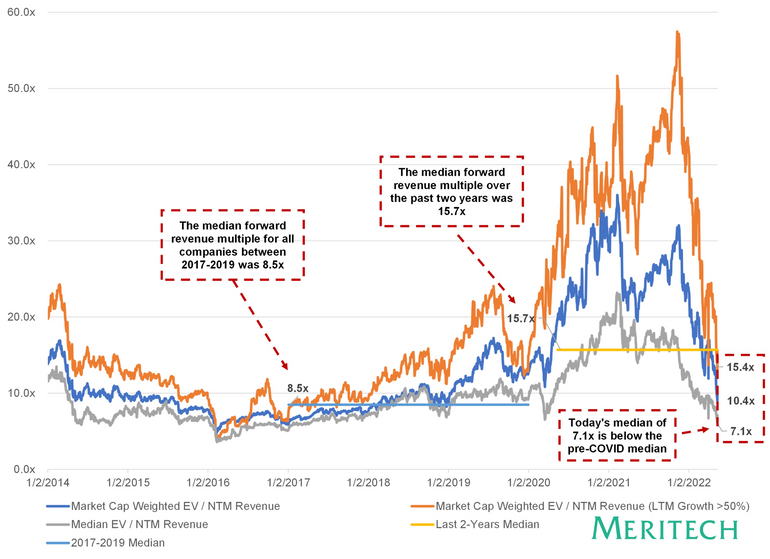

In the last 6 months, public SaaS companies have lost about half of their market value; at its high in 2021, the cumulative SaaS market cap was over $2T; it is now down about $1T.

Overall, the average SaaS market cap is down roughly 57% from its 12-month highs. Forward revenue multiples, the main method used to value public SaaS companies, have decreased on average by 67 percent from their 12-month highs and by nearly 90 percent for some businesses. On average, public SaaS revenue multiples have decreased from 15x during the peak to 7x today.

What are the implications for early-stage SaaS companies? Several VCs have spoken about extending runway, lowering burn, and aiming for positive unit economics. We wanted to take this opportunity to dive deep into SaaS metrics – to detail out metrics and benchmarks needed to grow a sustainable business in SaaS.

Why are metrics important? For external stakeholders, such as investors, metrics indicate future revenue potential and drive valuations. For internal stakeholders, employees, and leaders, metrics help streamline the company to a common, measurable goal and drive sustainability. We hope this serves as a cheat sheet for founders building sustainable SaaS businesses over the next decade.

“If you can’t measure it, you can’t improve it” But what’s important to measure?

SaaS companies that have hit PMF. PMF differs across the board for SaaS companies.

“First to market seldom matters. Rather, first to product/market fit is almost always the long-term winner.”

Rules of thumb for PMF:

- Revenue & Growth: Double-digit growth when you have hit $10K MRR is an indicator of PMF (Source: SaaStr) Additionally, an increase in ACVs per customer or an increase in usage or accounts per logo can be an indicator of PMF.

- Customer Validation: Survey existing users to understand ‘how they would feel if they could no longer use the product?’ – According to Stephen Millard and Joshua Olusanya, if over 40% of users say ‘very disappointed’ you have hit PMF (Source: Notion VC, PMF frameworks) In other words, hit +40% customer NPS.

- Marketing spend: Ideally, in the easiest stages of a product development process, pull is happening organically (i.e., without any advertising spending) (Source: a16z on PMF) One of the most common ways that startups die is “premature scaling,” a term first used by Steve Blank. A business is “scaling prematurely” if it is spending significant amounts of money on growth before it has discovered and developed PMF.

Few additional resources to understand whether you have hit PMF –

It is important to note that SaaS metrics become most relevant post the PMF stage – however, it is good to track metrics early on to get a high-level understanding of what is working and what is not.

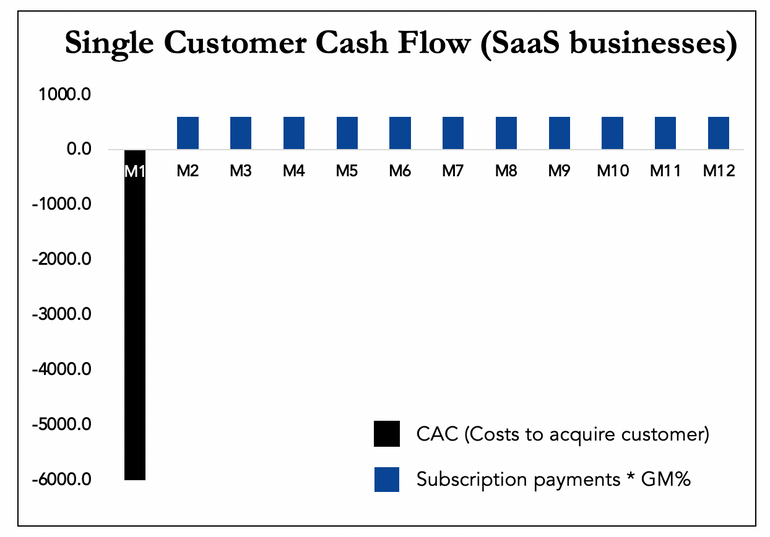

Typically, businesses used GAAP (Generally Accepted Accounting Principles) to measure the health of their businesses. However, SaaS businesses operate very differently from normal businesses due to the nature of their recurring revenue. At the start, SaaS companies need to lose a lot of money to acquire accounts. We typically see a negative cash flow trough in SaaS companies before they begin generating steady subscription revenue.As stated in this article, you can browse your selection of available deals on smartphones and top brands and explore the cell phone service plans that best suit your needs.

SaaS businesses are highly sensitive to small variables in key metrics. Through this article, we demystify specific levers of growth as well as outline common benchmarks for some of these metrics. It is important to note that benchmarks may vary given the stage, customer acquisition strategy, and average contract value of your SaaS business.

What really matters if you’re raising capital for your SaaS company – repeatability, scalability, profitability

What are the core drivers of repeatability, scalability, and profitability?

1. Quantity of Revenue

Revenue, especially for SaaS companies, can be a deceptive metric. SaaS companies can have a mix of services, recurring, and one-time revenues that can be contracted, billed, or realised. To cut the noise from the clutter, focus on MRR.

| Metric | Notes | Benchmarks (if applicable) |

|---|---|---|

| MRR | For a SaaS business, monthly recurring revenue is a much more valuable metric to track than traditional revenue. It’s the total revenue you received during the month that came from recurring subscriptions. Important to track different types of MRR – | Last 5 Year Averages Seed: $0-50K MRR Series A: $50–200K MRR Series B: $200-500K MRR |

| Existing MRR | Monthly revenue from your current users. (Baseline to grow from) | – |

| New MRR | MRR generated by new customers. (Note: measure marketing spends against New MRR) | Median 70-60% of MRR (When total MRR is < $250K) 50% of MRR (When total MRR i >$1M} |

| Expansion MRR | Additional MRR from existing customers. | Median ~30% of MRR, when total MRR is > $1M |

| Lost MRR | Lost MRR from cancellations & downgrades. | Determines churn rate |

| Contraction MRR | Lost MRR from customers who downgraded. | 30% of Lost MRR |

| Churned MRR | Lost MRR from customers who canceled their subscriptions. | 70% of Lost MRR |

| Re-activation MRR | MRR generated by customers who come back to use the product. | Median 9-13% of MRR |

| ARR | MRR x 12, will be different from the last 12 months of revenue. | – |

| ARPA | Average Revenue Per Account (MRR / # of Active Accounts) | Higher ARPA correlates to lower revenue churn |

| ACV | Value of a customer’s contract over a 12-month period. | – |

| Customer Lifetime Value (LTV) | The average amount of money that your customers pay during their engagement with your company – Indicates what your average customer is worth. (ARPA x 1/Customer churn rate) An effective way to calculate LTV is to analyse cohorts (12 months to 3/5 years) | – |

| Bookings | Bookings represent the commitment of a customer to spend money with your company. (Contract signed) | Important to track – Bookings to Revenue Conversion (Time taken, drop-off rates) |

| Revenue | Revenue happens when the service is actually provided. | – |

| Billings | Billings is when you actually collect your customers’ money. (Cash inflow) | – |

2. Quality of Revenue

While the quantity of revenue is the most important metric to track, the quality of revenue determines the growth and sustainability of future revenues. Key metrics, that indicate the quality of revenue, are linked to churn. High churn indicates you will not be able to compound your revenue and your cost of acquisition will not be optimised.

| Metric | Notes | Benchmarks (if applicable) |

|---|---|---|

| Revenue Churn | The rate at which monthly recurring revenue (MRR) is lost, as a result of lost customers and downgraded subscriptions. [(Month 1 MRR – Month 2 MRR)/Month 1 MRR] 2 types of Revenue Churn (Net Churn & Gross Churn) | – |

| Gross Churn | akes into account the MRR lost via churn and contraction from your existing custom | Unsustainable 10-15% gross MRR churn Post PMF Median <5% gross MRR churn Best in class 1-2% gross MRR churn For SMBs (10K ACVs) Target 30% gross ARR churn |

| Net Churn | akes into account both the MRR lost (via churn and contraction) and gained (via expansion and reactivation) from your existing subscriber base. As ARPA increases, the potential for negative net churn increases. How to achieve a Negative Churn? Requires variable pricing axes – important for the expansion of revenue • users (#of users in an org) • features (advance features – basic, pro, enterprise) • depth of usage (e.g., storage, database) | Post PMF Median 5.8% – 1% Target Negative net churn |

| Customer Churn | The rate at which existing customers cancel subscriptions. Also known as logo churn. (Customers churned at period t/ Total customers at period t) | 90-95% is common for enterprises, 85% for mid-market, and 70-80% for small businesses. |

| Net Revenue Retention (Dollar Retention) | Measures how much revenue is generated in each period relative to its original size. Dollar Retention takes expansion revenue into account and can be greater than 100% if expansion exceeds churned and contracted revenue. | Best in Class SMB: 100% NRR Mid-Market: 130% NRR Enterprise: 140% NRR |

| Quick Ratio | Revenue growth over a particular time period (i.e., New MRR + Expansion MRR) with revenue shrinkage over the same timeframe (Churned MRR + Contraction MRR) | Best in Class Quick Ratio = 4 |

| Customer Concentration | Is growth being driven by a few big contracts or many small ones? | On Average, the largest customer pays <10% of the total MRR |

3. Sales Efficiency

For growth to be effective and sustainable, it is crucial to examine sales efficiency. Uneconomic expenditure levels can always be used to generate “fake” growth. The indicators listed below can be used to compare the value of new clients against the cost of obtaining them in order to assess sales efficiency.

| Metric | Notes | Benchmarks (if applicable) |

|---|---|---|

| CAC | Costs to acquire new customers. (Sales & Marketing Spend / New Customers) How to lower CAC? • Lower cost of leads • Increase funnel conversion rates • Increase PPR • Reduce human touch • Simplify lead time (sales to go live) | – |

| $ CAC | Costs to acquire new $. (Sales & Marketing Spend / New MRR) | – |

| LTV / CAC | The lifetime value of your customers and the total amount you spend to acquire them. | Rule of Thumb LTV/CAC = 3-4x Best in Class LTV/CAC > 5x |

| Payback Period | Measures the number of months it takes to generate enough revenue to cover the cost of acquiring a customer. (CAC / MRR x GM) For early-stage companies, payback period is a better metric than LTV/CAC since LTV is difficult to determine accurately. | Rule of Thumb Payback Period < 12 months Best in Class Payback Period < 5-7 months |

| SaaS Magic # | Net New ARR in a period divided by S&M expense from the prior period | Ideal: >1 |

| Productivity Per Rep (For outbound sales) | (New MRR for a specific / # of Sales Reps) PPR is impacted by 2 factors: quality of people hired, also impacted by onboarding & training • Important to monitor PPR (time series), Monitor PPR by each sales person | Best in Class 50% reps should be above 100% quota |

| Sales Capacity | The number of productive sales reps is a key driver of bookings. Planned revenue should be backed by sufficient sales capacity. (# reps x weekly hours x weeks per year x % hours spent on sales x % closing ratio of the team) | – |

| Revenue per lead | The average amount of revenue each lead (as opposed to customer) will contribute. (New MRR / Number of Leads Per Month) | – |

| SaaS sales funnel • Lead Generation • Trials • Pilots • Conversion • Onboard • Retain • Expand | The metrics that matter for each sales funnel vary from one company to the next depending on the steps involved in the funnel. Measuring conversion % at each stage of the funnel can provide transparency to the sales process. Early on, important to experiment with the conversion of cohorts the by lead source – and then double down on the highest conversion | Link to SaaS Funnel Conversion Benchmarks by Industry & Channel |

4. Potential of Future Revenue

In addition to quantity & quality of revenue, below are a few metrics that indicate a healthy pipeline of future revenue.

| Metric | Notes | Benchmarks (if applicable) |

|---|---|---|

| MRR Growth | Growth is faster in the early stages. As companies mature, the median growth rate slows down. | MoM Growth Medians by MRR Band • MRR <$10K: ~70% • MRR $10-50K: ~40% • MRR <$50-100K: ~30% • MRR <$100-250K: ~25% • MRR <$250K-1M: ~20% • MRR >1M: ~18-15% |

| Rate of expansion | [(Expansion MRR month-end – Expansion MRR month beg) / Expansion MRR month beg] | Best in Class 15-20% or +20% Target 10-15% |

| Rate of won contracts | Total opportunities won over the total opportunity won + lost | – |

| Referral ROI | Applies for companies that give referral incentives. To compare the amount we’re spending on customer referrals with the revenue those referrals will generate over their lifetime. Measures $X in LTV for $Y in referrals. [(LTV – Referral Incentive)/ Referral Incentive] | – |

| Customer Engagement Metrics | ||

| DAU/ MAU | The ratio of daily active users to monthly active users. | Average 40% during non-holiday weekdays (Defers based on the type of SaaS) |

| DAU/ WAU | The ratio of daily active users to weekly active users | Average 60% during non-holiday weekdays (Defers based on the type of SaaS) |

| NPS | Customer satisfaction is key to ensuring low churn. One way to measure that is through customer surveys. The net promoter score (NPS) is the most popular metric for customer satisfaction. | The median NPS score for B2B companies is 29 |

| CSat | CSATs can provide a simple window into the type of service you offer, and function as a valuable complement to NPS measurements. | A good CSat score for B2B companies is +60% |

5. Profitability

Metrics and benchmarks of profitability in a SaaS business.

| Metric | Notes | Benchmarks (if applicable) |

|---|---|---|

| Gross Margin | Gross Margin reflects a company’s margin after subtracting the cost of goods sold (COGS) from revenue. For SaaS companies, COGS typically consist of hosting costs, any data or software needed for the product to operate, and the cost of frontline operations. | +75% is good, privately-held SaaS is 70-80%, below 70% is red flag (Note: gross margins might vary if pass-through costs are high or if the SaaS is implementation or customer success heavy) |

| EBITDA Margin | Most important for mature SaaS companies. A useful metric to calculate Rule of 40 (Note: Rule of 40 is not a relevant metric for early-stage companies, only becomes important at the pre-IPO stage – currently < 50% of publicly traded SaaS companies hit the Rule of 40) | TTM revenue growth rate + adj. The EBITDA margin is 37% |

| Gross Burn Rate | Amount of money a company spends in a month. | – |

| Net Burn Rate | The amount the company loses in a month. (Gross Burn Rate – Revenue) | Profitable companies have a negative net burn rate |

| Zero Cash Date | Predicted date your startup runs out of cash, as a result of your current burn rate, and assuming no new revenue generation. | – |

| Burn Multiple | Net Burn is divided by its Net New ARR in a given period. | Best in class <1-1.5 Target 1.5-2 |

| Free Cash Flow (FCF) | Free Cash Flow is the amount of uncommitted money a business has after covering all of its expenses. In many SaaS companies, FCF can be significantly greater than op. profits because – (1) contract-length/ pre-payments (2) cash collection policy (billing 1 month or 1 year in advance) In certain cases, high FCFs drive valuation multiples higher | – |

References & additional material: