THE OPPORTUNITY

The global carbon markets are experiencing unprecedented growth, with the market expected to reach $1.8 trillion by 2030, driven by compliance requirements and corporate net-zero commitments. Today, over 4,000 companies have received approval for their Science-based Climate Action Targets, with many discovering that achieving true net-zero requires more than just emissions reduction—it demands high-quality carbon removal solutions.

However, a significant quality gap exists between buyer expectations and current market offerings. Buyers are increasingly willing to pay premium prices for high-integrity carbon credits that demonstrate additionality, permanence, and robust quantification. Yet most existing players in the Global South lack the technology infrastructure and operational depth to deliver such verified, scalable outcomes.

The compliance carbon market, representing 90% of the global opportunity, is particularly underserved when it comes to nature-based solutions that combine carbon removal with community benefits. With India’s Compliance Carbon Market (ICM) set to launch in 2026, there’s a critical window to establish leadership in high-quality carbon project development.

This market inflection point, combined with the growing demand for verified carbon removal solutions, presents an enormous opportunity for players who can control the entire value chain from project origination to credit issuance while maintaining the highest standards of scientific rigor.

THE UNIQUE APPROACH

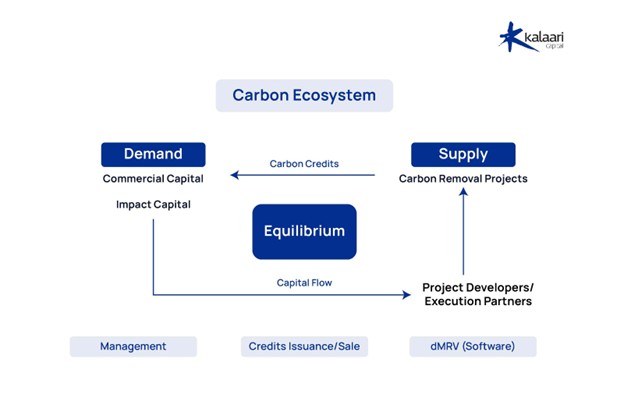

Equilibrium offers a full-stack carbon project development platform that controls every aspect of the carbon credit lifecycle—from project origination and financing to monitoring, verification, and credit issuance. This end-to-end approach is crucial in a market where quality control and transparency are paramount.

AI-enabled Gains in Asset Management-

The company’s project portfolio spans four complementary verticals: agroforestry, regenerative agriculture, mangrove restoration, and biochar production. This diversification is strategic, as it allows Equilibrium to serve different buyer preferences while building operational synergies. For instance, their biochar operations can utilize agricultural waste from their regenerative agriculture projects, creating integrated waste-to-value pathways.

What sets Equilibrium apart is their robust digital Monitoring, Reporting, and Verification (dMRV) stack. Their proprietary technology platform combines satellite imagery, ground-truth data, and automated reporting to track critical parameters including soil organic carbon, tree metrics, biodiversity indicators, and socio-economic impacts. This level of scientific rigor addresses the core challenge facing carbon markets today—the need for verifiable, high-integrity credits.

Equilibrium combines impact capital, carbon finance, and commercial investment to deploy funds efficiently and de-risk projects, already securing a $2 million facility that benefits 10,000+ smallholder farmers. Since 2022, its blended-finance model, robust dMRV, and strong execution have reached 60,000+ farmers and coastal communities, positioning the company as a leader in high-quality carbon removal.

THE FOUNDING TEAM

Siddhanth Jayaram (Founder & CEO) has a background in venture capital and industrial engineering from Purdue University, equipping him with both market insight and analytical rigor to navigate the evolving carbon economy. He has worked closely with founders, investors, and ecosystem partners, giving him a deep appreciation for the capital and governance structures needed to scale credible climate solutions.

Sricharann Seshadri (Co-founder) brings strong expertise in financial structuring and investment management. His ability to design blended finance models and mobilize multiple pools of capital has been central to Equilibrium’s early traction with carbon investors and philanthropic partners.

Neelesh Sachdeva (Head of Strategy & Origination) brings over 15+ years of expertise in climate change, carbon markets, and sustainable agriculture. A seasoned leader in business development and global carbon trading, he has facilitated the trade of over 15 million credits across renewable energy, nature-based, community, and tech-driven solutions.

The founders’ methodical approach has been one of their biggest strengths. From establishing research partnerships with premier institutions to building proprietary carbon quantification models based on 50+ public research databases and collaborations with IISC, UHS and IWST, they have invested deeply in science-led credibility.

THE WAY AHEAD

This seed funding will support Equilibrium’s expansion across 8 projects in 9 states, covering 120,000 hectares and reaching 150,000 farmers — with the potential to generate 20 million tonnes of high-quality carbon removal. Alongside scaling its nature-based solutions, the company is doubling down on biochar, a high-value, high-permanence removal pathway increasingly sought by buyers.

Equilibrium also plans to deepen its technology moat by enhancing ground-truthing and expanding its dMRV platform as a standalone product. With strong early traction, the platform is already proving valuable to carbon investors and developers seeking transparent, verifiable monitoring solutions.

Siddhanth Jayaram, Founder of Equilibrium, comments: “Our mission is to bring scale and durability to carbon removal through a permanent switch to climate-resilient agriculture, and this requires sustained, appropriate pools of capital to execute long-term projects. Having raised impact & carbon-finance earlier this year, we’re glad to raise our seed round of equity investment. It’s a long road to planetary restoration, and we’re grateful to have investors that share our belief in patient, committed ambition.”

Sampath P, Partner, Kalaari Capital, says: “What drew us to Siddhanth and his team is their clarity on what it takes to make carbon removal work at scale — permanent shifts to climate-resilient agriculture, backed by strong digital and operational infrastructure. Their ability to pair rigorous execution with farmer-first outcomes gives us confidence in Equilibrium’s potential to build India’s leadership in high-quality carbon removal. We’re excited to support them on this journey toward climate-positive agriculture.“

Kalaari Capital is an early-stage, technology-focused venture capital firm based out of Bengaluru, India. Since 2006, Kalaari has empowered visionary entrepreneurs building unique solutions that reshape the way Indians live, work, consume and transact. The firm’s ethos is to partner early with founders and work with them to navigate the inevitable challenges of fostering ideas into successful businesses. At its core, Kalaari believes in building long-term relationships based on trust, transparency, authenticity, and respect.

If you are a founder building an early-stage company, write to us at pitch@kalaari.com