Founders (L-R): Vibhav Viswanathan, Mithun Madhusudan

In the 1960s, Eugene Fama developed the Efficient Market Hypothesis (EMH), which argues that financial markets are informationally efficient—meaning asset prices always reflect all available information. As a result, consistently achieving excess returns (alpha) is theoretically impossible, as any new information is rapidly incorporated into prices.

Yet, despite EMH, top money managers continue to outperform the market by exploiting inefficiencies and price-value anomalies. However, in today’s era of high-frequency trading (HFT) and quantitative investing, these alpha-generating opportunities are vanishing faster than ever. The key differentiator for funds is no longer just identifying inefficiencies but exploiting these short-lived information asymmetries with speed and precision.

Financial markets: Ripe for disruption

The world of investment management moves more slowly than tech. The Bloomberg Terminal, launched in 1982, remains essential today. Algorithmic trading began in the 1990s but only became mainstream in the 2010s. Throughout different periods, innovation in financial research and investing has been constrained by varying combinations of technology readiness, computational power, and institutional adoption barriers.

But now we stand at a juncture where all the above factors have reached an inflection point. Investors are now using AI for tracking market sentiment, scanning earnings transcripts, analyzing financial statements, and parsing regulatory filings.

Yet, most existing solutions still have a few gaps-

- They either cater to quant funds and tech- first large institutions or are in-house, require significant custom integration and ETL work, leaving a gap for a more out-of-the-box, intuitive, product-led approach.

- Data lies in many different silos, Workflows are still discrete, necessitating multiple tools, leaving room for a lot of efficiency and quality of output.

But things are a-changin’, in fact, 70% of financial market firms are already adopting AI in some form. Some archetypes that we have seen in emerging startups-

- Workbench: Solving for Low Research Bandwidth, reducing analysts’ time on redundant tasks

- Data++: Enriched datasets, incorporating alternative data, etc.

- Faster & more efficient services: AI-powered Due diligence, M&A research.

- Sales & Customer Client management: Co-pilots for wealth management teams

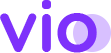

AI-enabled Gains in Asset Management-

The Market

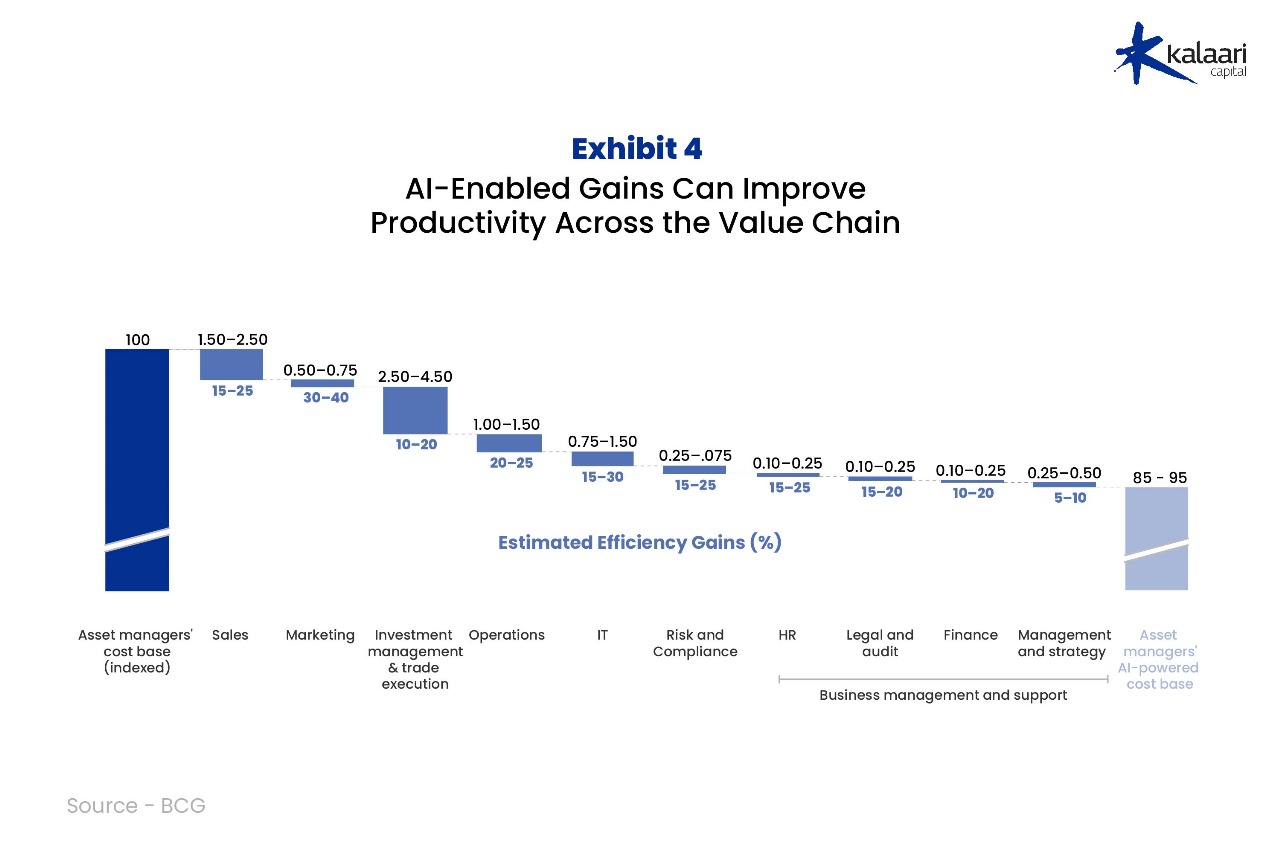

The Global Asset management industry is close to $128T in AUM, out of which close to $65T is from actively-managed funds. A significant part of the cost incurred in Investment management & trade execution goes into research & analytics. As per BCG’s Global Asset Management Report 2025, here is a breakdown of an Asset manager’s costs.

While the wallet share of financial intelligence tools is currently much smaller (close to $40B), it is still substantial. Furthermore, there is an immense scope for TAM expansion as access to AI tools becomes more widespread. Customers generally have a high propensity to pay. A typical $300M-$500M PE firm uses at least 3-5 platforms. Some of these tools are often mission-critical, especially if they improve operational efficiency or alpha generation. With a large universe of more than 35,000 potential customers across both buy-side & sell-side, we also believe that the market is not winner-takes-all, but is consolidated enough to allow new entrants to capture meaningful share, with GenAI positioned as a key growth driver.

Pascal’s approach

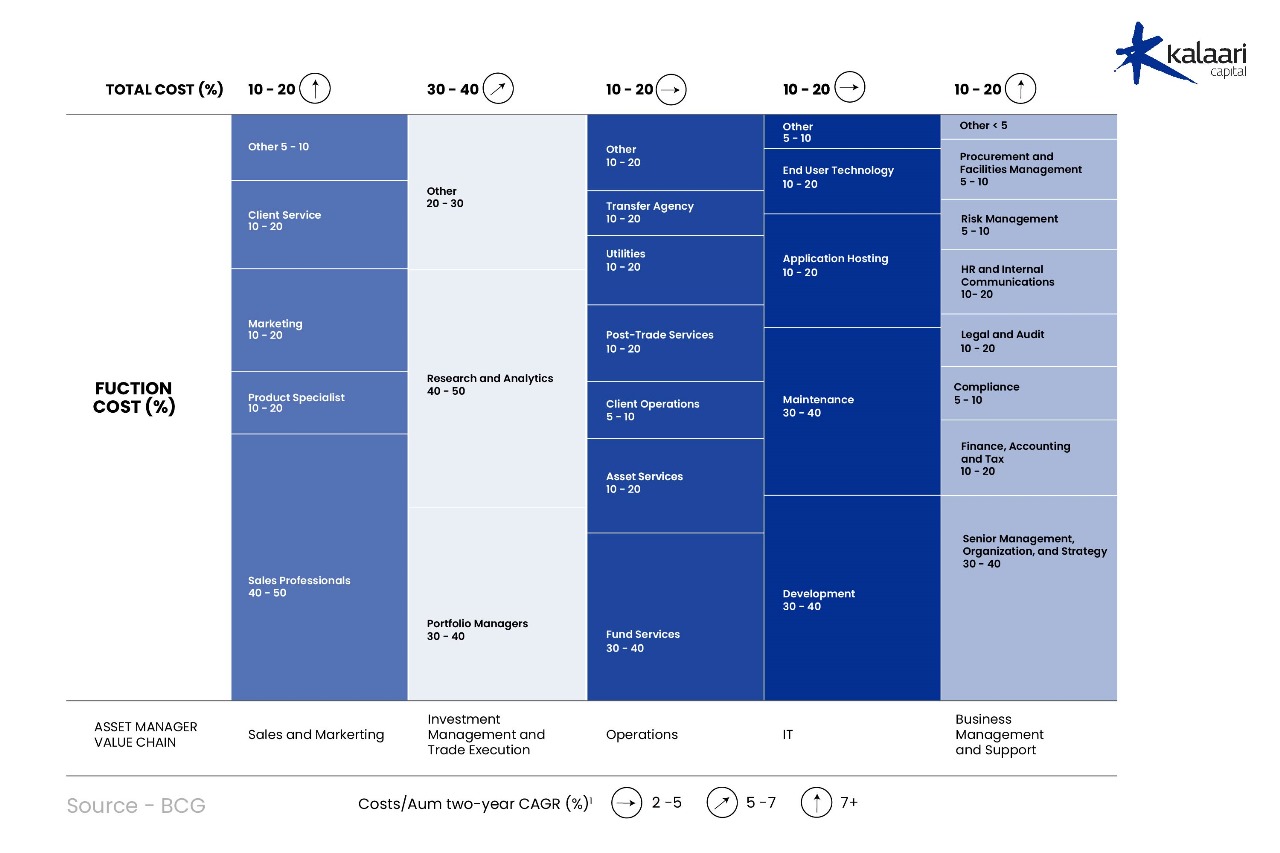

Pascal Labs aims to solve for this space by enabling investors to focus on what truly matters: decision-making.

Microsoft Excel remains an analyst’s go-to tool. While that won’t change that won’t change anytime soon, picture a workflow where repetitive tasks in investing—such as extracting, cleaning, and isolating a company’s data—can be streamlined. Instead of manual effort, analysts can now simply prompt an AI model to generate the same output instantly, saving time and reducing inefficiencies.

According to Deloitte, leveraging AI can save 45.5 working days per analyst annually. Firm-wide, reducing these redundant tasks could prevent 5-10% AUM loss resulting from missed insights due to time spent on tedious, redundant tasks.

Pascal AI aims to go beyond productivity— to accelerate both Time-to-Insight and Time-to-Execute, driving smarter, faster decision-making.

The Founding Team: Product Builders Who Understand AI

The Pascal Labs team is one we’ve known closely for years. We’ve watched Vibhav’s journey from investing roles—at Kalaari and The Capital Group—to building cutting-edge AI infrastructure at AWS Neuron, and later driving product as Chief Product Officer at MPL. His journey brings a unique combination of deep investing acumen, technical expertise in AI, and proven product leadership.

His co-founder, Mithun, brings equally impressive credentials to the table. He has held technical leadership roles at multiple high-growth companies, first at ShareChat, where he helped the platform scale beyond 100 million monthly active users, and later at Apna, where he launched and scaled multiple products.

The duo shares a long-standing bond from their days at IIT Kharagpur, and together they have assembled a stellar engineering team with extensive experience in building enterprise-grade financial tools, firmly positioning Pascal AI Labs to build scalable products at the convergence of Investing and AI.

Looking ahead

As AI reshapes the investment landscape, the winners will be those who combine technical innovation with exceptional user experience. With this fundraise, Pascal aims to build an enterprise-ready platform and put it in the hands of their customers

We are at the cusp of a technological shift with AI-powered financial research—one where insight is instant, workflows are seamless, and decision-making is smarter than ever. At Kalaari, we’re thrilled to partner with Pascal Labs as they redefine how financial professionals interact with AI, and we strongly back Pascal Labs to bring their vision to reality.

Vibhav Viswanathan, Co-founder and CEO talks about Pascal’s vision-

“The future of investment management is autonomous investment research. Pascal AI is systematically automating complex investment workflows with the long-term vision of creating a fully autonomous investment research company. I’ve had a long relationship with Kalaari. They share our global perspective and moved with conviction, making the decision in a day. They were the natural choice to lead this round,” said Vibhav Viswanathan, co-founder and CEO of Pascal AI. “This funding allows us to accelerate that journey, moving from workflow automation to true autonomy, and giving analysts instant, auditable insights and CIOs a continuously updated view of exposures and performance”.

Sampath P, Partner at Kalaari Capital, says-

“At Kalaari, we believe the next decade will see a decisive shift toward autonomous research platforms that can scale human judgment with machine intelligence. Pascal AI is at the forefront of this transformation, building secure, auditable, and truly agentic workflows that don’t just process information, but reason like an investor. What stood out to us was the clarity and conviction with which Vibhav and Mithun are reimagining how private and public market investors and CIOs make decisions. With strong early traction from marquee global clients, the team has already validated the depth of the problem and the strength of their solution. We are excited to partner with them on this mission.”

Kalaari Capital is an early-stage, technology-focused venture capital firm based out of Bengaluru, India. Since 2006, Kalaari has empowered visionary entrepreneurs building unique solutions that reshape the way Indians live, work, consume and transact. The firm’s ethos is to partner early with founders and work with them to navigate the inevitable challenges of fostering ideas into successful businesses. At its core, Kalaari believes in building long-term relationships based on trust, transparency, authenticity, and respect.

If you are a founder building an early-stage company, write to us at pitch@kalaari.com